How are the NeuroMoney Features Built for Low Cognitive Load?

At launch, NeuroMoney, an ADHD and autism friendly money management tool, will focus on three simple but powerful jobs: planning shopping, keeping track of subscriptions, and understanding your bills. Everything is designed to work with a neurodivergent brain, not against it.

A calmer way to plan spending

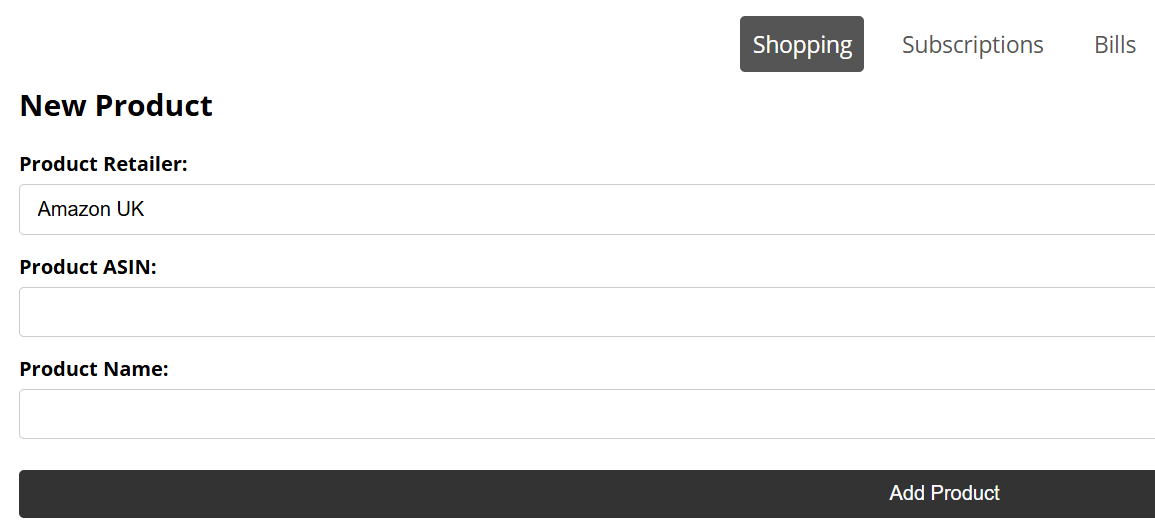

NeuroMoney includes a cross-platform shopping list builder implementing multiple third-party retailers. You can save the products you use often in everyday life – from food to household basics to personal “essentials” – in one easy-to-read, unified view.

At launch, the shopping page is designed to work with major online retailers such as Amazon, eBay and Walmart. The goal is to make it easier to remember what you need, when you need it, and where you usually get it, without needing to search each retailer from scratch every time.

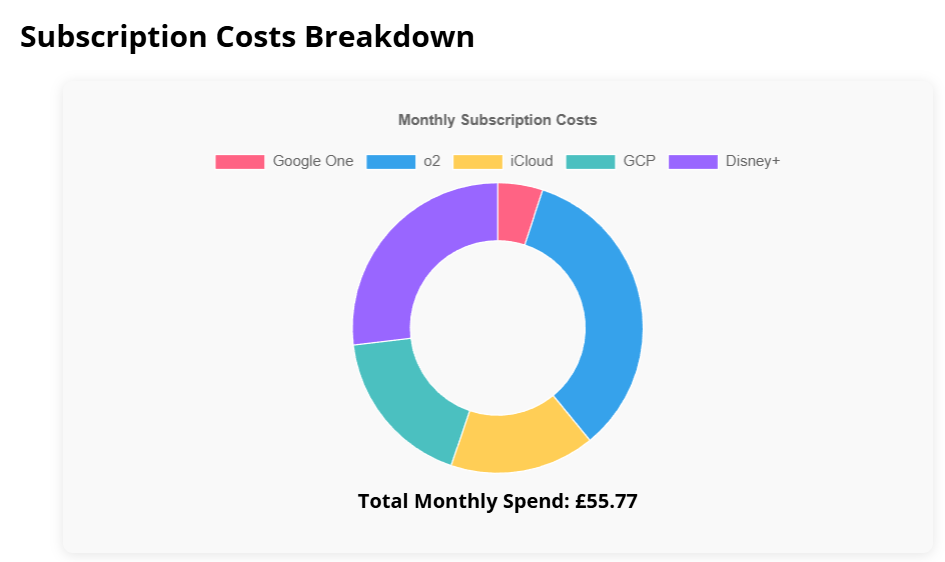

See all your subscriptions in one place

NeuroMoney lets you log streaming services, apps, memberships and other recurring payments. They’re grouped by monthly or yearly cost, so you can see the total impact on your budget at a glance. You can then see a breakdown of your spending in a visual, colourful graph, that gives a quick simple breakdown of your recurring payments. The goal is to reduce “surprise” renewals and make it easy to decide what still feels worth keeping.

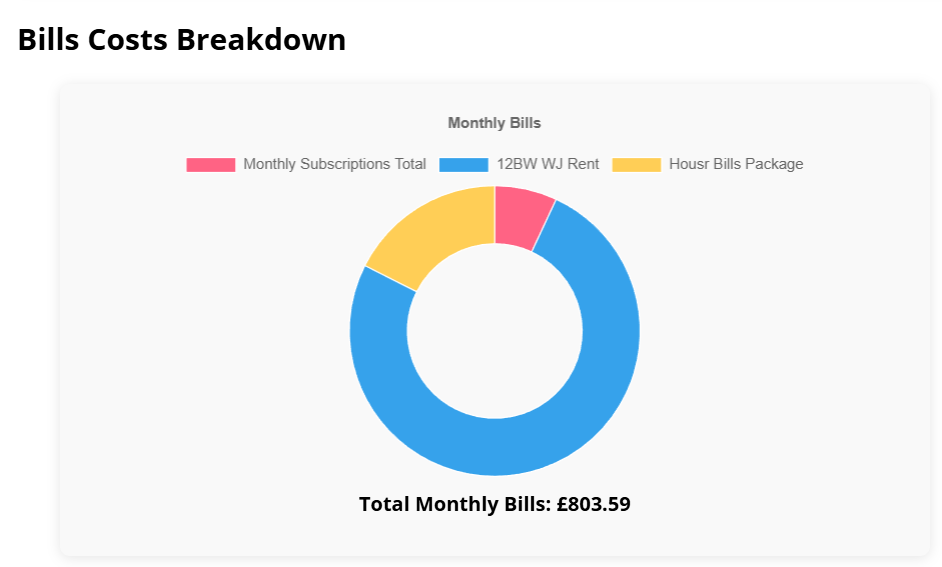

Bills that are predictable, not scary

Fixed costs like rent, utilities and essential repayments are shown in a calm, structured view. You can see how much of your income is already committed and how much is left for everyday life. Just like the subscription tracking tool, the bill tracking tool also has a nice colorful breakdown graph. As the app grows, the aim is to support gentle reminders and simple schedules, not a constant stream of alerts. Furthermore, for continuity and ease, your subscriptions are automatically extrapolated to the bills page as your first recurring monthly expenditure amount.